You should ensure that:

- You understand your responsibilities as a surety.

- You receive a copy of the Note of Contract when the loan is granted to the borrower.

- The moneylender has explained the terms in the Note of Contract in a language you understand.

- The moneylender does not keep your NRIC card or any other personal ID documents (e.g., driver’s license, passport).

What should I do after being granted a loan?

CHOOSE YOUR

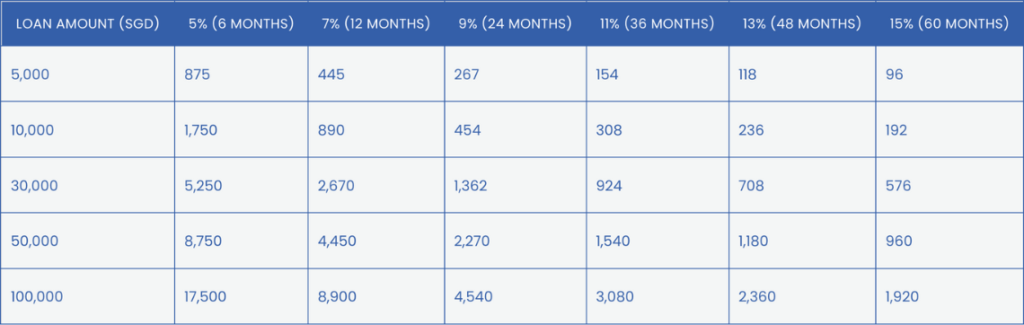

We offer option as low as SGD 2,000!

TESTIMONIALS

Client Reviews

Mr. Lim

“I applied for a personal loan to cover medical expenses, and the entire process was fast and easy. The team was professional and helped me every step of the way. Highly recommended!”

Mr. Tan

“When I needed a personal loan for a family emergency, this service provided quick approval and transparent terms. I’m very satisfied with how everything was handled.”

Miss Chan

“I was looking for a personal loan to fund my vacation, and this website made it incredibly simple. Fast service, no hassle – I’ll definitely use them again!”

Madam Wong

“This personal loan service exceeded my expectations. The application was straightforward, and I got my funds quickly. Excellent customer support throughout!”